Throughout the 17th and early 18th century, Sweden had a significant empire in northern Europe. In 1700, an alliance of Denmark-Norway, Russia, and others attacked the Swedes. While Charles XII, then the king of Sweden, had initial success against this alliance, he was eventually wounded and the Swedes never really recovered. Charles died in 1718. Charles had taken power at the age of 15 and spent virtually his entire adult life at war. He never married nor did he have children. When he died, there was uncertainty about who had the rightful claim to the throne. Charles’s sister Ulrika claimed that she was the rightful heiress since she was the closest living relative. Ultimately, the Swedish Riksdag agreed to recognize Ulrika in exchange for eliminating the absolute monarchy and setting up a parliamentary system. In this new system, the political power was concentrated in the Riksdag. The period from 1721 – 1772 is therefore known as “Frihetstiden”, or the Age of Freedom.

During the Age of Freedom, the Riksdag was dominated by two political parties that were referred to as the Hats and the Caps. The Hats controlled power for nearly 30 years beginning in 1738 and were mercantilists (their motto was “Svensker man i svensk drakt”, or “Swedish men in Swedish clothes”). In 1739, The Hats used the Swedish central bank, the Riksens Standers Bank (what is now known as the Riksbank), to give loans to private industry. These loans were funded with the creation of bank notes. In addition, the Hats started an ill-fated war with the Russians over parts of Finland. During this time, Sweden was effectively on a copper standard, but the expansion of bank notes for the provision of private lending and the use of the bank to finance the war ultimately led to the suspension of convertibility into copper in 1745. The increase in the provision of private credit by the central bank continued. In the 1750s, Sweden entered the Seven Years War to fight alongside their French allies. Sweden was particularly involved in the Pomeranian War with Prussia over land that they had lost in the Great Northern War under Charles XII (discussed above). The Hats were hesitant to levy any new taxes to pay for the war because to do so would require calling the Riksdag and therefore divulging the state’s budget. As a result, loans to the Crown increased substantially during the war and the supply of bank notes increased correspondingly.

The Hats seemed to view the money supply as a limiting factor in development. They thought that an increase in the money supply would increase aggregate demand, which would encourage greater production and entrepreneurship. Increases in the money supply could apparently have a permanent effect on output. The opposition party, the Caps, countered that this increase the supply of bank notes was excessive and that the excess supply of money was causing rising prices and a depreciation of the exchange rate. By 1765, the public voted the Caps into power and the Hats become the main opposition party. Upon taking power the Caps decided to decrease the money supply in order to restore the price level and the exchange rate to what it had been prior to this expansion. What followed was a major decline in the supply of bank notes and a very costly deflation. The deflation was so costly that it pushed the Caps out of power and returned the Hats to power. Ultimately, a coup ended the parliamentary system and restored the monarchy. Shortly thereafter, Sweden adopted a silver standard.

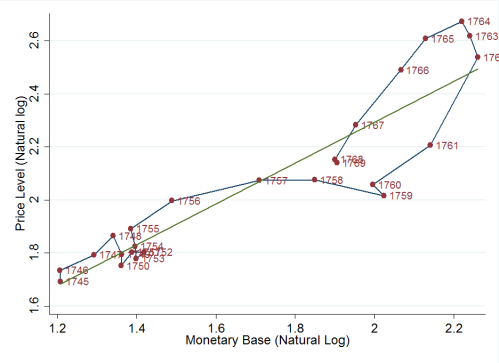

So why give you all of this history? The reason is that this series of events represents a sort of quasi-natural experiment regarding monetary policy. The Hats engaged in a deliberate increase in the money supply to increase economic activity and finance a war. What followed were significantly higher prices and a depreciation of the exchange rate. The increase in the money supply can be considered exogenous in the sense that the change in the money supply was brought about through deliberate policies by the Hats and is therefore immune to claims that higher prices were causing an increase in the supply of bank notes. The subsequent reduction of the money supply by the Caps brought about a significant deflation. Again, this was a deliberate attempt by the Caps to reduce the money supply and is therefore immune to claims of reverse causation. As Johan Myhrman notes “it is almost like a controlled experiment.” Below is a line graph of the monetary base and the price level during the period in question (the source is Riksbank historical statistics). I have also plotted the best linear fit of the data. As shown in the figure, there is a standard quantity theoretic interpretation of the data. Given the quasi-experimental nature of the period, this would seem to provide strong evidence in favor of the quantity theory of money under an inconvertible paper money.

The same story could be told of American colonial currency, John Laws’s Mississippi bubble, the American Continental Currency, the French Assignats episode, and probably hundreds of others. In each case, people in a cash-starved economy find that issuing adequately backed paper money will relieve the cash starvation and stimulate the economy without causing inflation. But then people forget the importance of backing and issue more paper money without getting adequate backing in exchange, and inflation results. People then try to reduce inflation be restricting the issuance of money. This returns the economy to a cash-starved condition, and the cycle repeats.

Josh,

When you use the term “quantity theory of money”, are you referring to only the monetary base or also the total monetary aggregate?

Sumner believes in the “quantity theory of money” but in his case he only refers to the base as money because it is the medium of account, as deposits are just credit. So for him the price level is determined by the supply and demand for the medium of account, which is the base.

Glasner rejects the “quantity theory of money” but agrees with the Sumner that the price level is determined by the supply and demand for the monetary base.

Where do you stand on this?

Then the question remaining is that if money is not the cause for national progress or for that matter national decline, what is?

I believe that I know the answer but until you are completely aware that this history is true and that there is another more obvious factor, there seems to me to be no point in sharing this cause with you. Where I stand on this subject is in a state of disgust with the present way that governments helps to encourage this limitation which serves a small minority.and which effect leads to instability and poverty..

Pingback: Why does money inflate? - Investing Video & Audio Jay Taylor Media

Also, water flows down hill, the sun rises in the east, demand curves are downward sloping, and increasing the money supply causes inflation. I always enjoy this blog!

Nicholas Anderson se ha convertido en un buen empresario, responsable y profesional. Ofrece excelentes servicios mediante su compañia Royal Offshore